maryland earned income tax credit 2020

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year.

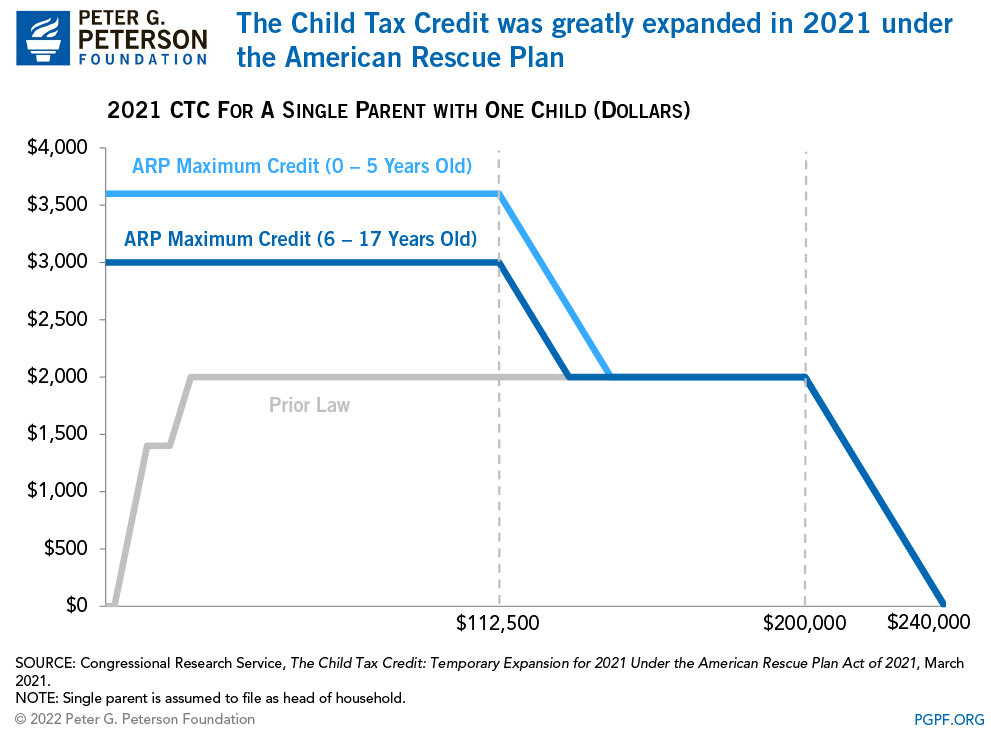

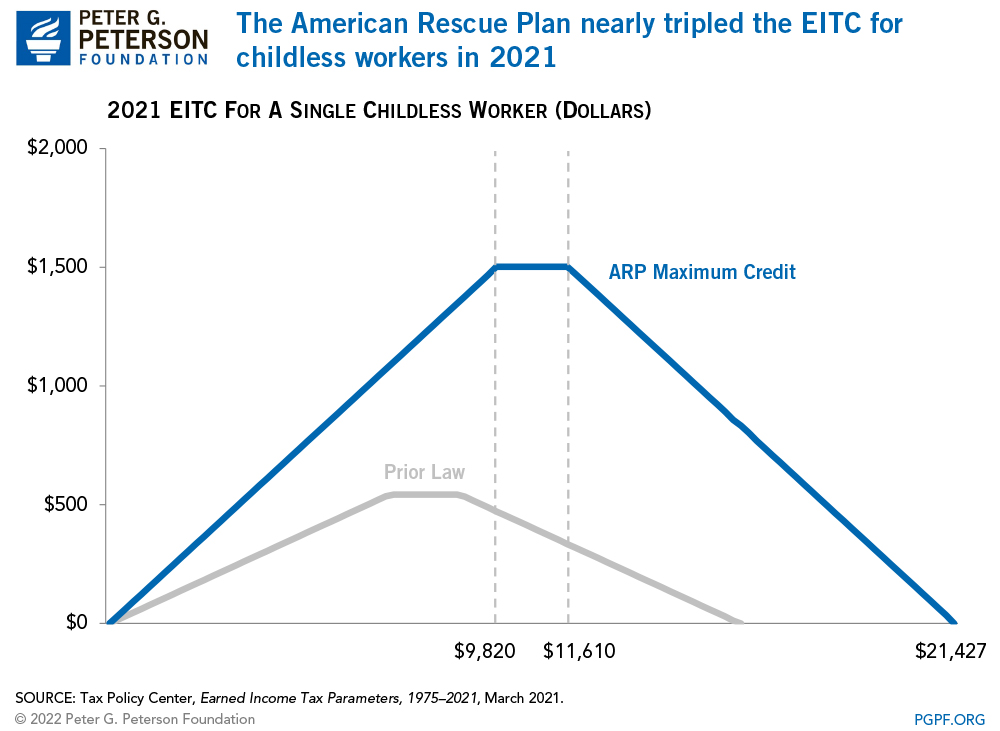

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

The EITC can be as much as 6660 for a family with qualifying children.

. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit. 50954 56844 married filing jointly with three or more qualifying children 47440 53330 married filing jointly with two qualifying children 41756 47646. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less.

Heres who qualifies PDF. If you have 50000 in monthly revenue and you collect 3000 in sales taxes you keep all 3000. Answer some questions to see if you qualify.

This is available for the 2021 tax year dependent on your adjusted gross income AGI. Maryland State Department of Assessments Taxation 2020 Renters Tax Credit Application RTC-1 Form Filing Deadline October 1 2020 Apply online wwwtaxcreditssdatmarylandgov Deadline extended through October 31 for 2020 only RTC-1v10 Jan 2020 Page 1 of 4 APPLICANT DETAILS. Baltimore MD The Maryland Energy Administration MEA has opened the application period for the Tax Year 2020 TY20 Maryland Energy Storage Income Tax Credit Program.

Last First Middle Initial 2. Generally if your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income Tax Credit. Karen and John are jointly assessed.

Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit. If you qualify for this credit it may offer significant tax savings. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18.

That group of taxpayers which. The maximum federal credit is 6728. The combined tax credits are 1400 which is less than the Employee Tax Credit.

50 of federal EITC 1. And applying the Act to taxable years beginning after December 31 2019. You may claim the EITC if your income is low- to moderate.

The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. HB 679 would increase the cap to adjusted gross.

Applying the Act to taxable years beginning after. The rebate caps at 750 for three kids. Find out what to do.

HB 679 increases access to the Maryland Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes. See Marylands EITC information page. Earned Income Tax Credit 2000 x 20 400.

Did you receive a letter from the IRS about the EITC. Jahmai Sharp-Moore 443-694-3651. If you are a part-year resident or a member of the military see Instruction 26o before completing this worksheet.

Income limits vary depending on your filing status AGI and the number of dependents. Under this order an employers 2021 tax rate will be calculated based. R allowed the bill to take effect without his signature.

See Worksheet 18A1 to calculate any refundable earned income tax credit. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. Karen is due two Earned Income Tax.

The maximum credit for the 2020 tax year is 6660 and the maximum income to. Eligibility and credit amount depends on your income family size and other factors. Calculate your federal EITC.

Social Security Number 3. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

Remember on your 2020 Return you can use the 2019 or 2020 income to determine your EITC. This program is designed to encourage the deployment of energy storage systems in the state. Allowing certain individuals to claim a refund of the credit.

On this step you will be asked about how you plan to file your taxes. Earned Income Tax Credit EITC. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC.

Earned Income Tax Credit EITC Rates. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. Allowable Maryland credit is up to one-half of the federal credit.

Currently the credit is capped at adjusted gross income of 15570 for people without children. UNEMPLOYMENT TAX RELIEF FOR SMALL BUSINESSES On December 10 Governor Hogan issued an executive order to prevent small businesses from facing major increases in their unemployment taxes. John has Case II income of 2500 for the same period.

Claiming the credits can reduce the tax owed and may also result in a larger refund. The expanded tax credit will arrive as soon as they file their 2020 tax returns and they will be eligible to receive that higher amount for the next three years. You must answer these questions in order.

If you are neither a Full-Year Resident nor a Part-Year Resident you are not a resident. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. For income between 10540 and 19330 the tax credit is a constant plateau at 3584.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. See instruction 26 in the Maryland Tax Booklet for more information on claiming the Earned Income Credit.

Karen is the assessable spouse she has Case I income of 50000 in 2020. Tax credit equals 034 for each dollar of earned income for income up to 10540. 28 of federal EITC.

If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year. If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

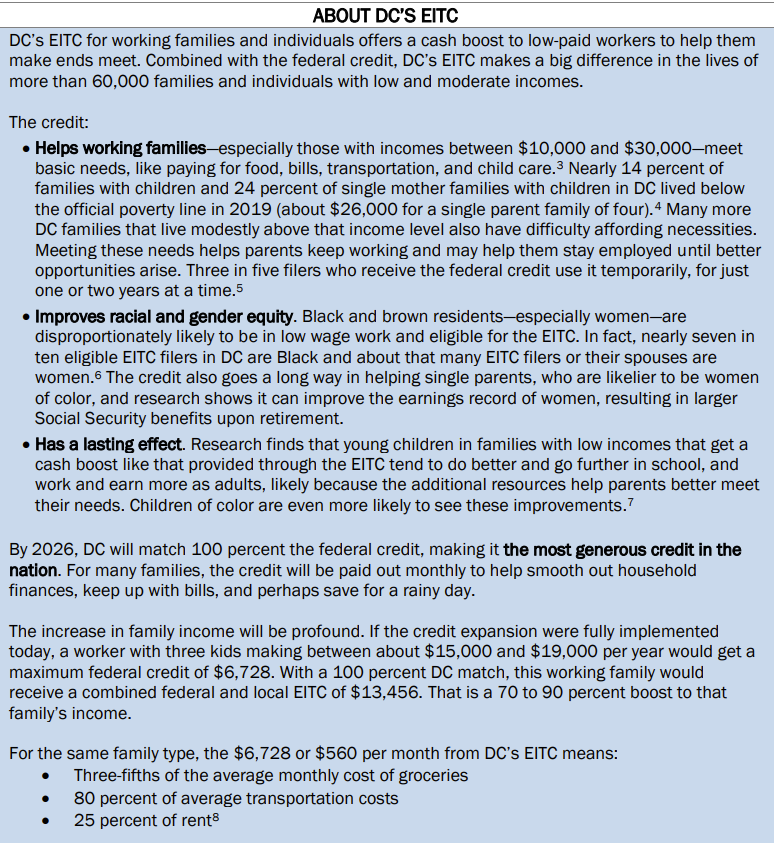

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

What Are Marriage Penalties And Bonuses Tax Policy Center

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

More Childless Adults Are Eligible For Earned Income Tax Credit Eitc

How Do State Earned Income Tax Credits Work Tax Policy Center

Earned Income Credit H R Block

Earned Income Tax Credit Eitc Interactive And Resources

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Earned Income Tax Credit Who Qualifies Changes For 2022

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Summary Of Eitc Letters Notices H R Block

Eic Frequently Asked Questions Eic

Earned Income Tax Credit Now Available To Seniors Without Dependents